A prolonged period of elevated long-term bond yields is ramping up borrowing costs around the world. That’s because investors are demanding extra compensation for holding government debt in the face of entrenched budget deficits, sticky inflation and burgeoning questions around central bank independence.

How Debt, Inflation and Politics Are Driving Up Borrowing Costs

Bloomberg Markets 11 hours ago 57

CC License

CC License- Homepage

- Technology

- How Debt, Inflation and Politics Are Driving Up Borrowing Costs

Related

Coca-Cola in Talks With TDR to Salvage Costa Coffee Sale: FT...

47 minutes ago

20

SpaceX executive confirms interest in an IPO

1 hour ago

47

TPG Takes $600 Million Hit on ‘Eyebrow Queen’ Cosmetics Bet

14 hours ago

63

Seagate, Alnylam Among Six Companies Set to Join Nasdaq 100

14 hours ago

62

The Fed’s Next Chair Faces AI Uncertainty, Political Heat an...

16 hours ago

63

OpenTable CEO on 2026 Dining Trends

16 hours ago

56

Airline Azul Wins US Court Approval of Restructuring Plan

17 hours ago

64

Stocks Slide as Tech Selloff Deepens | Closing Bell

17 hours ago

56

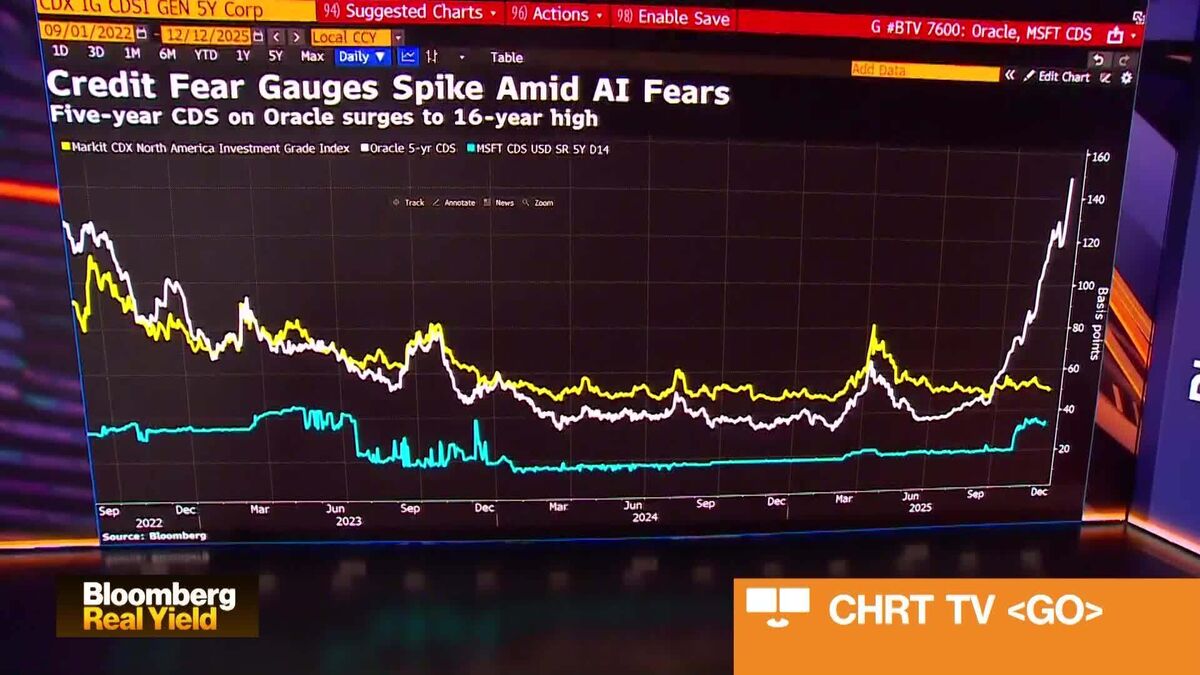

Overall Spreads Remain Tight Even As Oracle Debt Risk Jumps

18 hours ago

63

"Real Yield" Debate on Credit: Own or Not Own?

18 hours ago

61

Bloomberg Markets 12/12/2025

19 hours ago

72

Australian Lithium Miner Ioneer Eyes Bid for Rio’s US Boron ...

19 hours ago

61

The latest Top News, from leading exponents of , Stock Market, BlockChain, New Economy Accredited Sources.

Since 2015, our Mission was to Share, up-to-date, those News and Information we believe to represent in an Ethical and sincere manner the current Financial and Banking World.

| Learn More |

Financial Market Knowledge Base

BANKB.IT | Latest Financial NEWS

Please support BANKBIT: if you like it, share your favorite News to your Socials!

24h Most Popular

My Taiwanese immigrant friend started working in Walmart for...

21 hours ago

126

Trump May Demolish Historic D.C. Buildings With Priceless Mu...

22 hours ago

120

Tate Director Steps Down, Smithsonian Returns Khmer Sculptur...

18 hours ago

116

Will tightening supply send lithium prices soaring next year...

14 hours ago

82

Here’s how much money Heisman Trophy finalists Mendoza, Pavi...

18 hours ago

81

Robex Files Addendum to Information Circular in Connection W...

10 hours ago

80

Bombardier to Provide Six Multi-role Aircraft to Support the...

22 hours ago

79

Coinbase to soon unveil prediction markets powered by Kalshi...

21 hours ago

75

Bloomberg Markets 12/12/2025

19 hours ago

72

Illegal Miners Are Digging Gold at a $4.8 Billion Newmont Si...

21 hours ago

71

Utilities

Activity Links

Privacy and Cookie

Privacy and Cookie

Links

RSS | XML | Ping

© BANKBIT - World Financial News 2025.

All rights are reserved

.png)